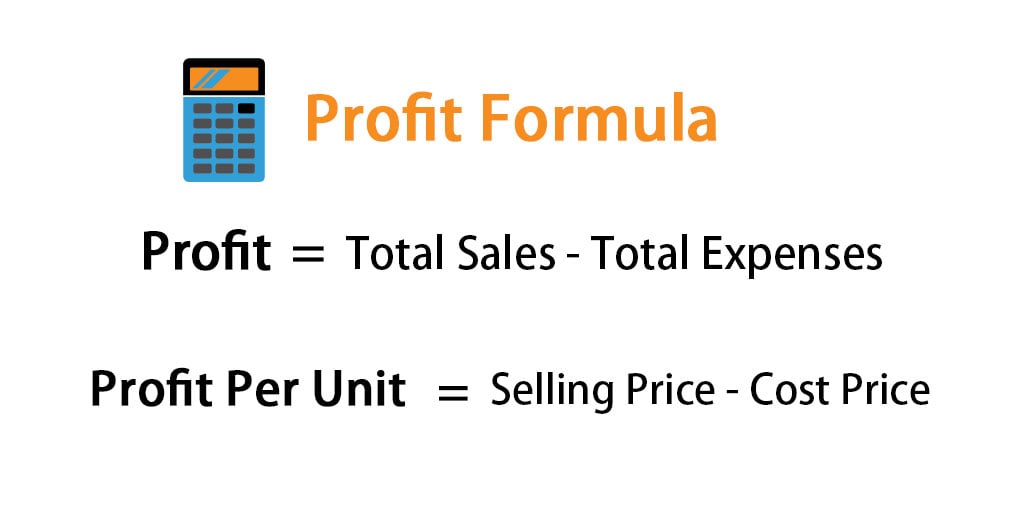

Profit amount formula

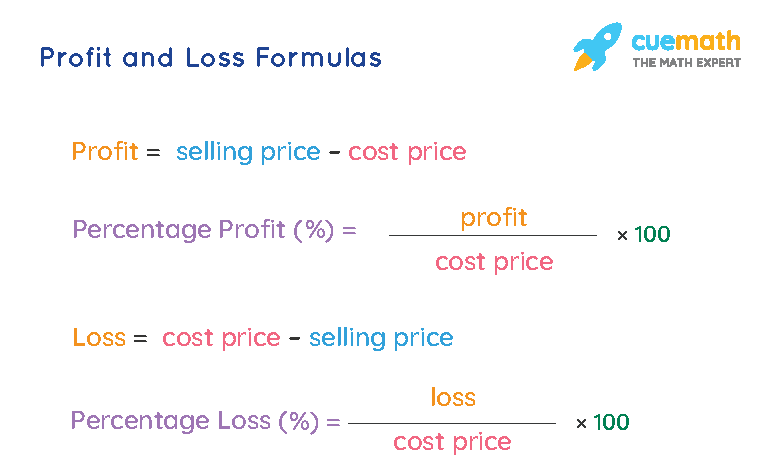

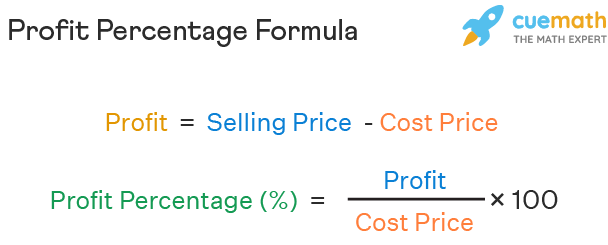

Calculate Book Profit Calculate Book Profit Book Profit is the profit amount that a business earns from its operations. Profit Percentage fracProfittextCost Price x 100.

Find Sale Price When Profit Percentage And Cost Price Is Given Youtube

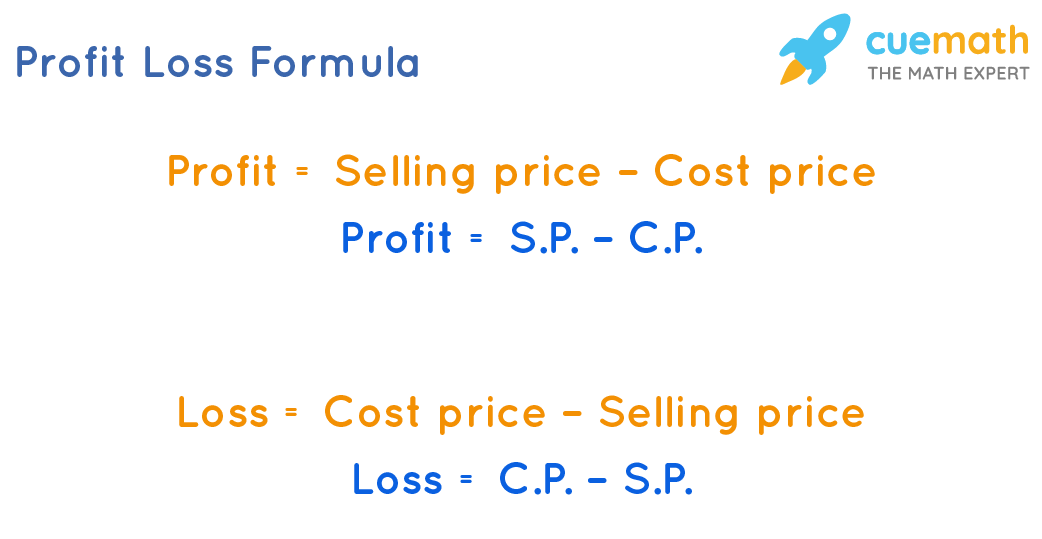

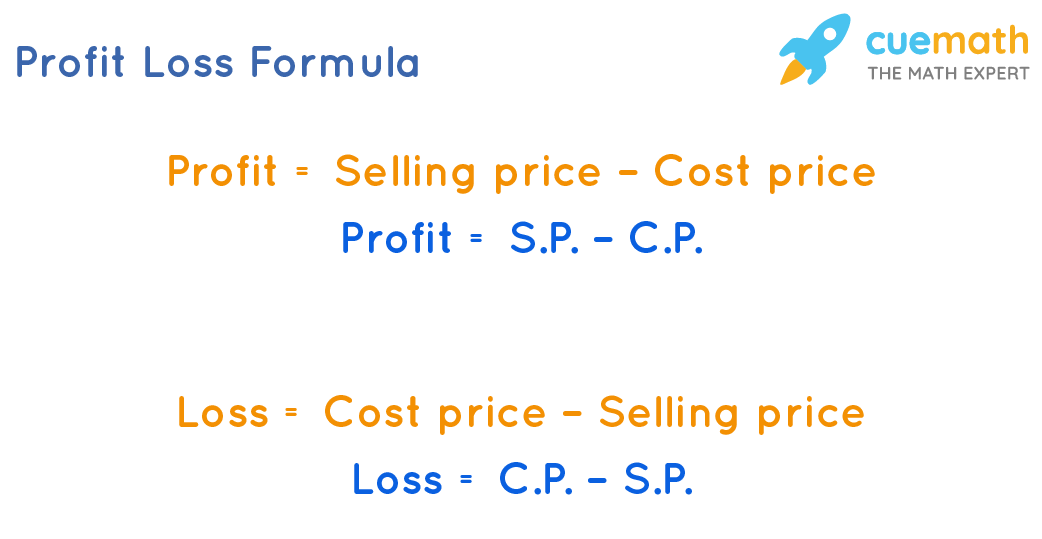

When the Selling price of a product is greater than its Cost price a profit is earned.

. ABC is currently achieving a 65 percent gross profit in her furniture business. Total Revenue - Total Expenses Profit. Then find the profit gained by the shopkeeper.

Net profit is calculated by deducting all company expenses from its total revenue. In other words it is a point at which neither a profit nor a loss is made and the total cost and total revenue of the. The target profit formula is a calculation used by businesses to estimate how much revenue the company should produce over a set period of time.

Profit is benefit realized when the amount of revenue gained from an activity exceeds the expenses costs and taxes needed to sustain the. Find the profit or loss using the profit formula then convert it to a profit or loss percentage by expressing it as a fraction with the cost price as the denominator. Gross profit will appear.

To calculate the amount. To calculate the profit or gain on any investment first take the total return on the investment and subtract the original cost of the investment. It is computed as the residual of all revenues and gains less all expenses and losses for the period.

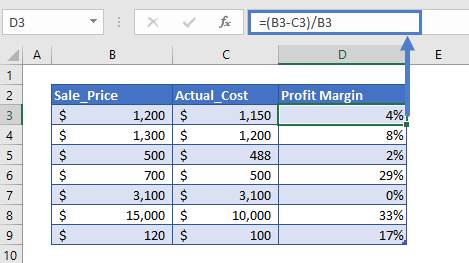

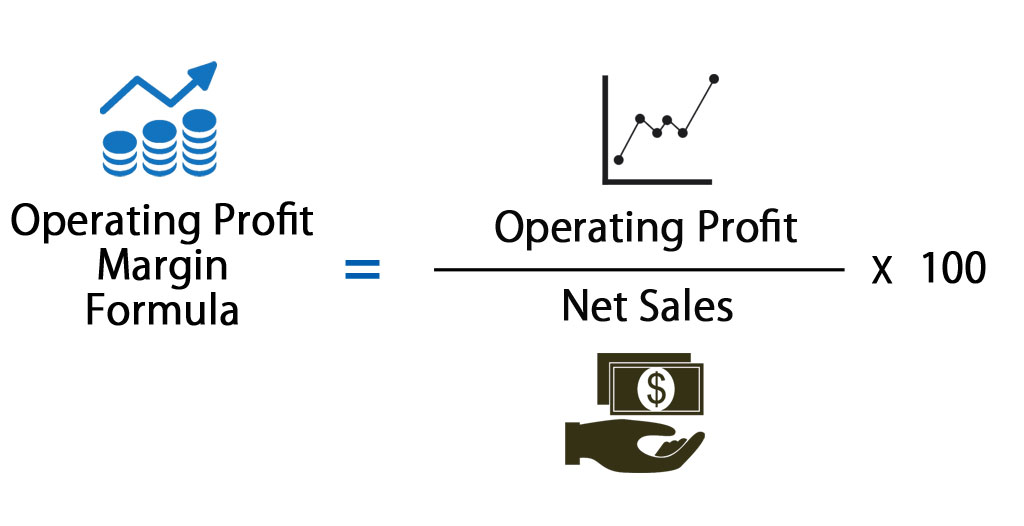

Profitability can be shown by calculating the gross profit using the gross profit formula. The optimal percentage for gross profit is 30 or higher. The profit formula is stated as a percentage where all expenses are first subtracted from sales and the result is divided by sales.

I signed up not knowing anything and within a few weeks I started getting not 1. Target profit analysis is about finding out the estimated business activities to perform to earn a target profit during a certain period of time. When I FIRST got started online one of the FIRST programs I ever made money with was a site called the Plug-In Profit Site.

This certain amount of profit is commonly known as target profit. Why Net Profit Margin Is Important. The profit formula plays a major role in any income statement Income Statement The income statement is one of the companys financial reports that summarizes all of the companys revenues and expenses over time in.

Net Profit Margin Formula. Gross margins must remain high to afford operating expenses. If a shopkeeper sells Apple at Rs200 per kg whose cost price is Rs150- per kg.

Using the above formula Company XYZs net profit margin would be 30000 100000 30. A business generates 500000 of sales and incurs 492000 of expenses. Many organizations use these two terms interchangeably to describe the amount.

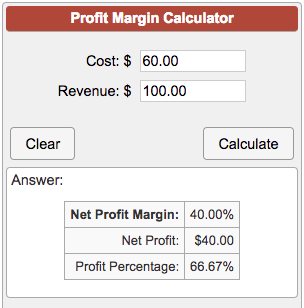

Meaning of Gross Profit Formula. Net Profit margin Net Profit Total revenue x 100. The result of the profit margin calculation is a percentage for example a 10 profit margin means for each 1 of revenue the company earns 010 in net profit.

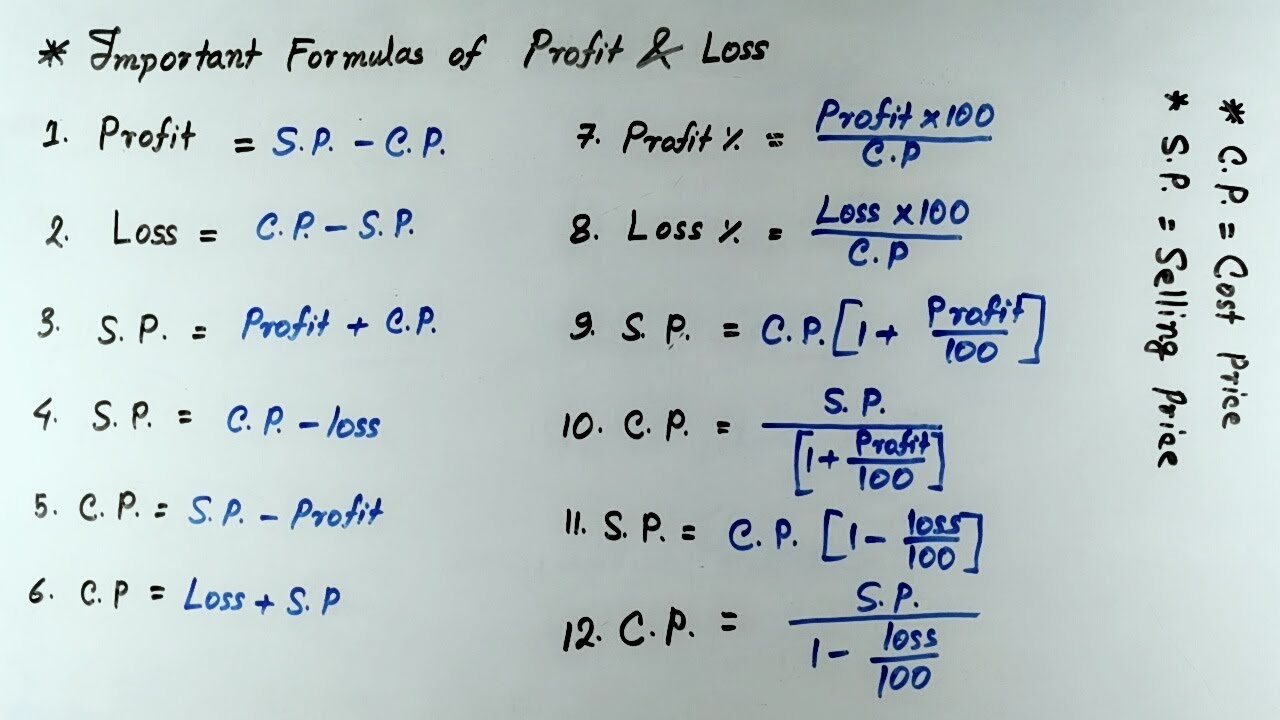

The formula of profit percentage is given as follows. The profit percentage formula calculates the financial benefits left with the entity after it has paid all the expenses and is expressed as a percentage of cost price or selling price. This funding is complimented by another recent award of 3 million in the states Fiscal Year 2022-23 budget.

Given Cost Price Rs150-And Selling Price. It is the amount of profit before all interest and tax payments. To calculate the profit margin divide the profit amount with cost price.

Gross profit margin is a financial metric used to assess a companys financial health and business model by revealing the proportion of money left over from revenues after accounting for the cost. Multiply the profit margin with 100 to get in percentage. It excludes the direct income and the expenses.

Every month you delay benefits increases your checks slightly until you reach. I am amazed at the amount of income your program is generating. Profit percentage is of two types.

This standard percentage is sufficient to cover most business taxes. The term profit refers to the financial benefit made when the amount of sales achieved from business exceeds the cost incurred in the process of the business activity. The result of its profit formula is.

And the percentage gain formula makes it easier and faster for a person to understand the variables or the vitals of a business transaction. Gross profit is the money or profit that a company makes after the selling cost and receiving cost is deducted. I earned 31000 in the last 72 hours after following your step by.

Paddle acquires ProfitWell to do it for you Get Profitwell Free Subscribe. Usually companies use this metric to help establish budgets forecast development potential and optimize investments. The amount depends on the industry and the companys management.

The formula for profit is very simple and it is expressed as the difference. A Markup expressed as a percentage of cost price. Gross profit is the profit a company makes after deducting the costs associated with making and selling its products or the costs associated with providing its services.

Among these activities management is especially interested to find out the sales volume required to generate a target profit. This makes up the basic profit formula which further helps in generating the percentage of profit that has been earned in a business or while making a financial deal. The profit formula is used to calculate the amount of gain that has been made in a transaction.

Net Profit Margin Formula. Gross Profit Margin can be calculated by using Gross Profit Margin Formula as follows Gross Profit Margin Formula Net Sales-Cost of Raw Materials Net Sales Gross Profit Margin 100000- 35000 100000 Gross Profit Margin 65. Read on about Dos Palos Library Project.

B Profit margin which is the percentage calculated using the selling. Which Profit Margin Formula Is the Most Useful. The Formula for ROI.

The formula to calculate profit is. It is an indication of a companys. Learn what net profit is how to calculate it using the net profit formula see some practical examples and how ProfitWell can help you get started.

Sales - Expenses Sales Profit formula. This formula is derived by evaluating the companys situation to achieve the break-even point Break-even Point In accounting the break even point is the point or activity level at which the volume of sales or revenue exactly equals total expenses. If you begin claiming at 62 youll get only 70 of your standard benefit if your FRA is 67 or 75 if your FRA is 66.

The formula of loss percentage is given as follows. In business and accounting net income also total comprehensive income net earnings net profit bottom line sales profit or credit sales is an entitys income minus cost of goods sold expenses depreciation and amortization interest and taxes for an accounting period. Net profit margin is an easy number to examine when reviewing the profit of a company over a certain period.

Businesses use this amount as an indicator of their profit before expenses. There are two main reasons why net profit margin is useful. Example of the Profit Calculation.

Percentage Gain means to express the profit or the gain in the form of percentages. Shows Growth Trends.

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Profit Formula Profit Percentage Formula And Gross Profit Formula

Gross Profit Percentage Double Entry Bookkeeping

Profit Margin Calculator

Profit Loss Profit And Loss Important Formulas Youtube

Profit Margin Calculator In Excel Google Sheets Automate Excel

Profit Formula Calculator Examples With Excel Template

Profit And Loss Formula Definition Calculation Examples

Profit And Loss Formula Examples Derivation Faqs

Gross Profit Margin Formula Meaning Example And Interpretation

Profit Margin Formula And Ratio Calculator Excel Template

Operating Profit Margin Formula Calculator Excel Template

Gross Profit Percentage Formula Calculate Gross Profit Percentage

Profit Percentage Formula Examples With Excel Template

Net Profit Margin Formula And Ratio Calculator Excel Template

Profit Formula What Is Profit Formula Examples Method

/GrossProfit-5c7ce1fdc9e77c00012f8248.jpg)

Gross Profit Vs Net Income What S The Difference